- Value Hack

- Posts

- Focus to Win

Focus to Win

Weekly Reading List

Focus is about saying no.

Focus is not the sort of thing you aspire to … or you decide on Monday. It’s something you do every minute.

What focus means is saying no to something that you, with every bone in your body, you think is a phenomenal idea and you wake up thinking about it, but you say no to it because you’re focusing on something else.

Organizations lose focus in many ways, but the one that causes the most damage is bureaucracy. An organization where committees make decisions will always end up losing focus. When an organization loses focus, it opens the door to competitors who can focus.

According to SEC filings, Tesla suffered a net loss of $140 million in 2022 thanks to the gamble. Their reported $64 million in trading profits were eclipsed by their $204 million loss. Tesla still holds somewhere around 11,000 BTC.

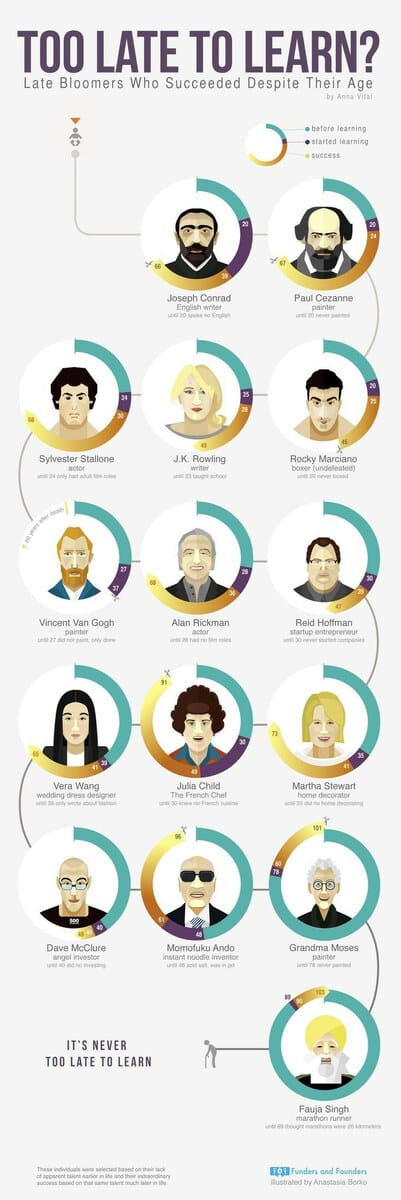

IT’S NEVER TOO LATE TO LEARN

“You never know what will be the consequence of the misfortune; or, you never know what will be the consequences of good fortune.”

To summarize what Buffett is saying: as consumers, we would always rather see lower prices of things we regularly buy, from hamburgers to gasoline. But when it comes to stocks, we feel better when stocks are rising, not falling. But rising prices are counterproductive if we are planning to be net buyers of stocks.

This PDF is the most valuable investing resource of all time.

Most people won’t take the time to read it.

I understand, it can take months.

But it’s worth more than any MBA.

If you’re truly dedicated to learn investing, read it:

danielmnke.substack.com/p/resources

— Daniel (@MnkeDaniel)

1:12 PM • Feb 1, 2023

"The best thing about @elonmusk is that he makes me question if I’m thinking big enough with my life."

@naval

— Navalism (@NavalismHQ)

11:12 PM • Jan 31, 2023

#SteveJobs would often test people, asking them "how many things have you said no to?"

- Jonny ive interview

— Value Hack (@value_hack)

5:42 PM • Feb 1, 2023

A strange – but good – rule of thumb is to put stocks with the lowest number of shares outstanding at the top of your research list.

Keeping share count low – and not splitting the stock – tends to be a sign of not really needing/caring about Wall Street.

— Andrew Kuhn (@FocusedCompound)

6:20 PM • Jan 30, 2023

YouTube